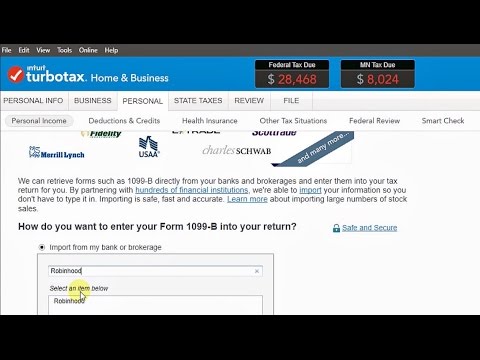

Music hello everyone I hope you guys are doing well have New Year's if you celebrate the Lunar New Year today I'm going to go through importing taxes I know I went through it before but I'll show you what it actually looks like under TurboTax if you use Robin Hood and you want to import your transaction so before we start I'm gonna do a quick review remember in my last video I talked about TurboTax and Robin Hood Robin Hood suggests that we use TurboTax because it's compatible with Robin Hood and you can sync your information in in my previous video I talked about the different versions on TurboTax there's the free you version so if you work for just a corporation if you work for let's say Walmart Target Toyota AT&T you just get a w-2 and you don't own a home you don't want to write things off and just get the federal free edition you can file it online it's quick it's a you don't have to be an accountant it takes about 1530 minutes the first time and after that it only takes it for you I've seen people then we'll do within 10 minutes or or less so very simple now if you have a deduction we're talking about donations we're talking about itemizing your deductions if you bought a car you bought a very expensive car you bought a lot of expensive things you want to write off its interest expenses on your student loans then get the deluxe now Robin Hood suggests that we get and well they require to get the premier or higher you do need the premier if you have investment which is stocks or dividends of you sell stocks or dividends it's considered investments get the...

Award-winning PDF software

Turbotax 1065 Form: What You Should Know

TIP: TurboT ax Home and Business is compatible with both Windows and Mac computers. You can create a Windows or a Macintosh installation of TurboT ax Home and Business software. TurboT ax Home and Business software is designed to ensure the customer is satisfied, that the software is fast, easy and simple to use, and that the user receives the best result in terms of tax compliance. TIMEOUT: TURBOT AX HOME AND BUSINESS DOWNLOAD Timeout When TurboT ax Home and Business is done, your home or business can easily manage and control the tax calculation and reporting. All the transactions done online are available for you to review and update. To begin, select “Start My Tax Return” to begin the tax return processing. Once the tax calculation is complete and tax return processing is complete, you can save your tax return into a digital (PDF) or print (Mountain Lion) file to refer back to during future tax time. It is important that you have made your initial payment by the due date. Use the software to: • Create a Windows or Macintosh installation of TurboT ax Home and Business software • Manage the tax collection process that takes place when you are involved in a tax transaction • Access data from previously filed tax returns and the IRS online information system, including the number of returns and the total amount of taxes owed. TurboT ax is the #1 choice by millions of Americans from across the US and overseas.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing TurboTax Form 1065